News

2023 EITI Global Conference

Parallel session "Is win-win possible? Transparent and sustainable resource taxation". A win-win extractive contract must benefit both the private investor and the community, through the collection of tax revenues. For greater transparency on tax systems, the Ferdi website dedicated to the taxation of mining industries provides access to a large database of legal and tax data on African countries. Over the last 10 to 15 years, this database shows that several major changes have taken place in African countries in the direction of increased taxation of mining industries. The assessment of rent-sharing is useful to governments in implementing mining and oil tax reforms, helping them to negotiate contracts, avoid renegotiation and better forecast revenues.

The Future of Resource Taxation

The IGF and ATAF have just released 10 innovative policy papers to take mining taxation into the 21st century! The ideas imagine a simpler, fairer, and more participatory system of financial benefit sharing. We want to know what you think of these ideas. How can we improve them?

Submit written feedback to Secretariat@IGFmining.org and Research@ATAFtax.org with the heading “The Future of Resource Taxation”. Register to join our webinar on December 8, 2022, 13:00-15:00 GMT.

Finally, a big thank you to all the governments and non-government partners that generously contributed their ideas. Together, we will ensure that mining delivers sustainable financial benefits for the future.

Distance learning 2023: Fiscal design in the African extractive sector

Would you like to learn about fiscal design in the African extractive sector and reflect on the main risks and problems posed by the taxation of this sector (aggressive tax optimisation, indirect transfers, VAT credits, etc.)? In partnership with the French Ministry of Europe and Foreign Affairs (MEAE), the IHEDD is opening a new session of its online training on fiscal design in the extractive sector in Africa.

This distance training will take place from April 24 to May 22, 2023. It will require approximately 15 hours of work on your part. In addition, you will benefit from a personalized follow-up from the various trainers. Apply before March 20, 2023. The price is 450 euros. A MEAE scholarship may be granted upon selection of applications. Only 40 places are available.

Distance learning 2023: Modeling the mining rent in Africa

Would you like to learn about the taxation of the mining sector in Africa and learn how to model mineral resource rent sharing? In partnership with the French Ministry of Europe and Foreign Affairs (MEAE), the IHEDD is opening a new session of its online training on modeling and mining taxation in Africa.

This distance training will take place from February 20 to April 10, 2023. It will require approximately 35 hours of work on your part. In addition, you will benefit from a personalized follow-up from the various trainers. Apply before January 16, 2023. The price is 450 euros. A MEAE scholarship may be granted upon selection of applications. Only 40 places are available.

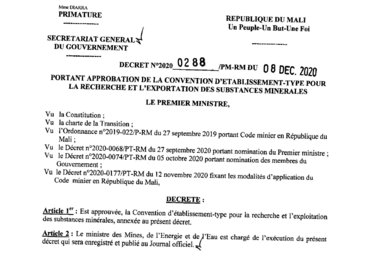

Update 2020: Guinea, Mali and Senegal

Updated tax data for 2020 are now available for Guinea, Mali and Senegal.

In Guinea, there have been no significant changes to taxation (Act No. 51 of 2019). Mali adopted a new Mining Act in 2019 (Ordinance No. 22 of 2019), accompanied in 2020 by its regulations (Decree No. 177 of 2020). Important changes concern the corporate income tax, the ad valorem royalty and the surface royalty. For a mine representative of an average grade (3g/t) and a fixed gold price of $1,400/oz, the average effective tax rate increases from 47.7% to 51.6%. In Senegal, the minimum collection amount of 500,000 CFA francs, provided for in terms of minimum tax, has been repealed (Act No. 17 of 2019), due to its "confiscatory effect on small and medium-sized enterprises in a deficit situation".