News

Burkina Faso value added tax: reintroduction of a reduced rate

Value added tax (VAT) was introduced in Burkina Faso on January 1st, 1993 (Act No. 4 of 1992). It initially had two rates: a full rate of 15% and a reduced rate of 10%. However, by 1994, the reduced rate had been abandoned in favour of a single rate (Act No. 27 of 1993). Initially set at 15%, this single rate was then increased to 18% in 1996 (Act No. 26 of 1996).

In 2020, Burkina Faso’s Finance Amendment Act reintroduced a reduced rate of 10% (Act No. 31 of 2020). This rate applies only to accommodation and catering services provided by hotels, restaurants and similar approved organizations. In the WAEMU, this measure is reminiscent of Senegal, which also reintroduced a reduced VAT rate of 10% in 2013 for accommodation and catering services provided by approved tourist accommodation establishments. However, this reduced rate has been restricted since 2015 to services provided by approved tourist accommodation establishments.

Distance learning 2022 : Mining taxation in Africa

Would you like to learn about the taxation of the mining sector in Africa and learn how to model mineral resource rent sharing? In partnership with the French Ministry of Europe and Foreign Affairs (MEAE), the IHEDD is opening a new session of its online training on modeling and mining taxation in Africa.

This distance training will take place from February 7 to March 15, 2022. It will require approximately 25 hours of work on your part. In addition, you will benefit from a personalized follow-up from the various trainers. Apply before January 31, 2022. The price is 450 euros. A MEAE scholarship may be granted upon selection of applications. Only 35 places are available.

Update 2020: Cameroon, Congo and DRC

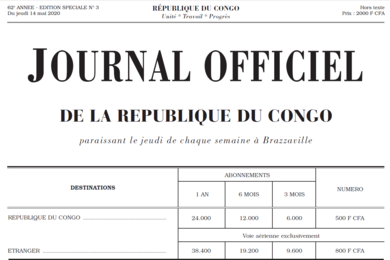

Updated tax data for 2020 are now available for Cameroon, the Republic of Congo and the Democratic Republic of Congo.

In Cameroon, deferred depreciation must now be carried forward before 10 years. In the Republic of Congo, the Finance Act, 2020 (Act No. 42 of 2019) and the Finance Amendment Act, 2020 (Act No. 23 of 2020) make two important changes in 2020. Firstly, the corporate income tax rate is reduced from 30% to 28%. Secondly, the tax on negative externalities of mining and hydrocarbon extraction activities, introduced in 2012, is repealed. In the Democratic Republic of Congo, taxation has not changed (Finance Act No. 19 of 2019).

Congolese corporate income tax: standard rate decreases

In the Republic of Congo, the standard rate of corporate income tax (CIT) has decreased steadily over the last decade. It was set at 36% in 2010, 35% in 2011, 34% in 2012, 33% in 2013, before stabilising at 30% in 2014. The Finance Amendment Act, 2020 (Act No. 23 of 2020) marks a new decrease. The corporate tax rate is now 28%.

However, this reduction does not concern all extractive industries. Mining companies remain subject to the 30% rate, in force since the Mining Act, 2005 (Act No. 4 of 2005), while oil companies may be subject to a higher rate in their petroleum agreement.

Congolese negative externalities tax: repeal eight years after its creation

In the Republic of Congo, the Finance Act, 2012 (Act No. 36 of 2011) had introduced in 2012 a “tax on the negative externalities of mining and hydrocarbon extraction activities”, known as a “pollution tax”. Situated in sections 171-P1 and following of the General Tax Code, volume 1, this tax amounted to 0.2% of the turnover of mining and oil companies in the production phase. It was levied for the benefit of the central State (60%) and local authorities (40%). It was not a deductible charge from the corporate income tax base. It was repealed in 2020 by the Finance Act, 2020 (Act No. 42 of 2019) and the Finance Amendment Act, 2020 (Act No. 23 of 2020).