News

Update 2020: Nigeria, Sierra Leone and Tanzania

Updated tax data for 2020 are now available for Nigeria, Sierra Leone and Tanzania.

In Nigeria, the Finance Act increases the value added tax rate from 5% to 7.5% (Finance Act No. 1 of 2020). In addition, the rate of the minimum tax is increased from 0.25% to 0.5% of turnover. In Sierra Leone, taxation has not changed (Finance Act No. 1 of 2020). In Tanzania, loss carry-forward continues to be allowed without time limitation. However, it is now limited to 70% of the taxable profit when the company has been in loss for four consecutive years (Finance Act No. 8 of 2020).

Nigerian Finance Act: several rate changes

In Nigeria, the Finance Act, 2019, has come into force in 2020 (Act No. 1 of 2020). It introduces several changes in tax rates. First, the corporate income tax (CIT) rate remains at 30% for large companies but is reduced to 20% for medium-sized companies (Section 16). Secondly, the rate of the minimum tax rate is increased from 0.25% to 0.5% of turnover (Section 14). Finally, the value added tax (VAT) rate, which has been fixed at 5% since its introduction in 1993, increases to 7.5% from February 1st 2020 (Section 34).

Tanzanian loss carry forward: restrictions in case of consecutive losses

In Tanzania, the calculation of the corporate income tax (CIT) base allows tax losses to be carried forward for an unlimited period. Then, they can be deducted from the taxable profit of subsequent years to reduce the CIT base. However, restrictions exist to limit the tax base erosion. Since 2008, a company that carries forward losses over three consecutive years has been required to pay an alternative minimum tax. Initially set at 0.3%, since 2018 this minimum is 0.5% of the company’s turnover.

Moreover, since 2020, Section 31 of the Finance Act (Act No. 8 of 2020) adds an additional restriction. A company that carries forward losses for four consecutive years can no longer reduce the tax base before loss carry forward by more than 70%. Losses can still be carried forward without any time limit, but only up to a limit of 70% of the tax base. Such a company must therefore pay at least 30% of the CIT that would have been due without the loss carry forward.

Distance learning 2021 : Mining taxation in Africa

Would you like to learn about the taxation of the mining sector in Africa and learn how to model mineral resource rent sharing? In partnership with the French Ministry of Europe and Foreign Affairs (MEAE), the IHEDD is opening a new session of its online training on modeling and mining taxation in Africa.

This distance training will take place from January 15 to February 5, 2021. It will require approximately 25 hours of work on your part. In addition, you will benefit from a personalized follow-up from the various trainers. Apply before December 7, 2020. The price is 450 euros. A MEAE scholarship may be granted upon selection of applications. Only 30 places are available.

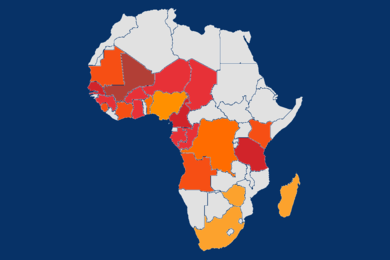

Update 2019: simulations of mineral resource rent sharing

Simulations are now available for the year 2019. These simulations make it possible to estimate the mineral resource rent sharing accruing to the State, i.e. the average effective tax rate (AETR), by applying a country's tax legislation to a mine representative of African gold mines.

Of the 22 countries in the sample, 6 experienced a change in their AETR in 2019. In Benin, Chad, Cote d'Ivoire and Mali, AETRs are increasing. While in Mauritania and Zimbabwe, AETRs are declining. However, variations in AETRs are fairly small, except in two countries where they may be particularly large. In Cote d'Ivoire, the elimination of the corporate tax exemption and the minimum tax exemption leads to an increase in the AETR of up to 8.6% for a high-grade mine and a price of gold set at $1,500/oz. In Zimbabwe, the introduction of a variable mining royalty rate based on the price of gold decreases the AETR by up to 26% for a low-grade mine and a price of gold set at $1,100/oz. Note that in Gabon, the coming into force of the new mining act did not result in a change in the AETR because mining taxation remained virtually unchanged.