News

Reform of the Congolese Mining Act: what changes?

The Democratic Republic of Congo (DRC) has in-depth reformed its Mining Act (Act No. 007/2002 of 11 July 2002 as amended by Act No. 18/001 of 9 March 2018). This reform increases on the one hand the mining royalty for precious metals whose rate goes from 2.5% to 3.5% and on the other hand the participation required by the State in the capital of the operating company which goes from 5% to 10% minimum. As a result, these measures increase the tax burden on gold mining companies. For a representative medium grade mine (3g/t) and a gold price of $1250/oz, the average effective tax rate (AETR) increases from 41% to 46%.

New Cameroonian Mining Act: what changes?

Cameroon has adopted a new Mining Act (Act No. 2016/017 of 14 December 2016). It reduces the ad valorem royalty rate for precious metals to 5%, whereas it was raised to 15% by the Finance Act, 2015 (Act No. 2014/026 of 23 December 2014). This new Mining Act therefore significantly reduces the tax burden applicable to gold mining companies. For a representative medium grade mine (3g/t) and a gold price of $1250/oz, the average effective tax rate (AETR) drops from 67% to 53%.

Blog : Tax convergence in the mining sector of WAEMU countries

The issue of sharing the mining rent between investors and States is of primary importance for WAEMU countries because of their need for resources for their development. While the analysis of legal texts shows that today the harmonization of mining taxation within WAEMU is partially a failure, the economic analysis of the average effective tax rates (AETR) of WAEMU countries reveals a certain convergence with the increase in the overall tax burden.

Update 2017 and 2018: Benin, Burkina Faso and Cote d'Ivoire

Updated tax data for 2017 and 2018 are now available for Benin, Burkina Faso and Cote d'Ivoire.

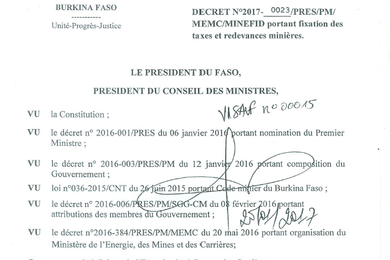

In Benin, the latest finance acts have not changed the mining taxation (Act No. 2016-33 of 26 December 2016 and Act No. 2017-040 of 29 December 2017). Burkina Faso has adopted a new general tax code (Act No. 058-2017/AN of 20 December 2017). In addition, the amounts of the fees and the annual ground fees have been modified by decree (Decree No. 2017-0023/PRES/PM/MEMC/MINEFID of 23 January 2017). In Cote d'Ivoire, the conditions for deductibility of interest have been tightened (Act No. 2017-870 of 27 December 2017).

What is the mineral resource rent sharing in Africa?

A video presentation of the legal and tax database to understand everything in 7 minutes.