News

New Kenyan Mining Act: what changes?

Kenya adopted a new Mining Act in 2016 (Act No. 12 of 2016), supplemented by 14 regulations in 2017. However, there is only one important change to note because most of the mining tax provisions are located in the Income Tax Act. The State now requires a free participation of 10% in the capital of industrial mining companies. This measure therefore increases the tax burden applicable to gold mining companies. For a representative medium grade mine (3g/t) and a gold price of $1250/oz, the average effective tax rate (AETR) increases from 41% to 48%.

Sierra Leonean Extractive Industries Revenue Act: introduction of a mineral resource rent tax and a stability clause

Sierra Leone adopted the Extractive Industries Revenue Act, 2018. It reviews both the country's mining and oil taxation. Concerning mines, the mining royalty is increased to 8% for high-value gemstones. Loss carry forward is more flexible. A mineral resource rent tax and a stability clause are inserted. However, the tax burden applicable to gold mining companies remains stable. For a representative medium grade mine (3g/t) and a gold price of $1250/oz, the average effective tax rate (AETR) remains at 42%.

Update 2017 and 2018: Ghana, Mali and Niger

Updated tax data for 2017 and 2018 are now available for Ghana, Mali and Niger.

In Ghana, the VAT rate was reduced from 15% to 12.5% in 2018 (Act 970). However, this reduction in the nominal rate hides an increase in the effective rate from 17.5% to 18.125%, including 5 "non-deductible" points. In Mali, the special tax rates on certain products (ISCP) were revised in 2018 (Decree No. 2018-0323/P-RM of 30 March 2018) without however changing the 5% rate applicable to gold bullion. In Niger, fixed fees were also revised in 2017 (Act No. 2016-43 of 6 December 2016).

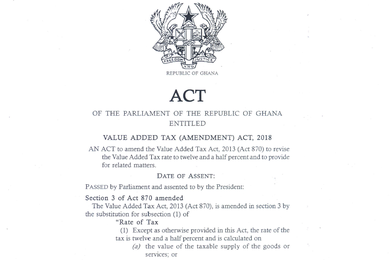

Ghanaian value added tax: decrease in the nominal rate but increase in the effective rate?

In Ghana, the VAT rate was reduced from 15% to 12.5% in 2018 (Act 970). However, this reduction in the nominal rate hides an increase in the effective rate from 17.5% to 18.125%, including 5 "non-deductible" points.

Indeed, the National Health Insurance Levy of 2.5% and the Education Trust Fund Levy of 2.5% are excluded from the VAT imputation mechanism. As the new VAT rate of 12.5% is applied after these two levies, goods and services are now taxed at 18.125%: [1 + (2.5% + 2.5%)] x [1 + 12.5%] = [1 + 18.125%].

Malian mining royalty: what is the special tax on certain products?

In Mali, the mining royalty is called "ad valorem tax". Its base is the value of the extracted substances, exported or not, minus the intermediate costs and charges. Its rate is 1% or 3% depending on the ore.

However, the country has a second royalty, called the "special tax on certain products" (ISCP). These are in fact excise duties, the basis of which is turnover excluding value added tax. Its rate is framed by law and fixed by regulation. Until 2012, it was 3% for all mining products. From now on it is 5% but only concerns gold and marble.